REAL ESTATE NEWS

June 30, 2014

The number of contracts to purchase previously owned U.S. homes jumped in May by the most in more than four years, a sign the residential-real estate market is rebounding after a slow start to the year.

The pending home sales index climbed 6.1 percent, the biggest advance since April 2010, after a revised 0.5 percent increase in April, the National Association of Realtors said today in Washington. The gain exceeded the most optimistic projection in a Bloomberg survey of economists, whose median forecast called for a 1.5 percent gain.

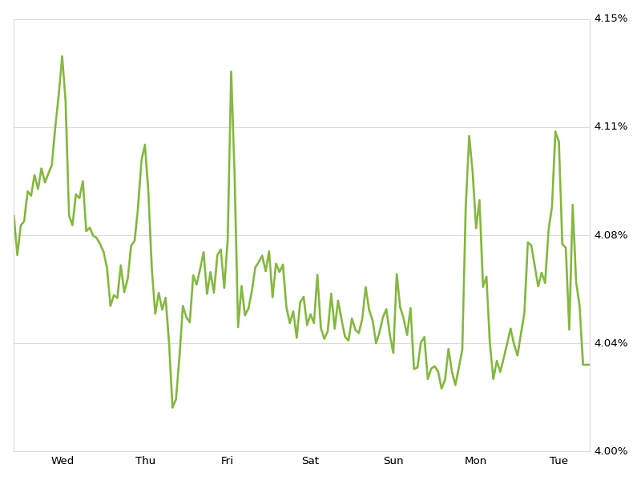

Housing demand is benefiting from cheaper borrowing costs, a stronger employment outlook and easier access to credit for some households. At the same time, higher prices and limited income gains are keeping the improvement in the residential real estate from becoming more broad-based.

“We’re still seeing somewhat of a rebound from the exceptionally bad weather in the first quarter,” Russell Price, senior economist at Ameriprise Financial Inc. in Detroit, said before the report. “I’d definitely expect to continue to see long-term improvement trends. It will still take some time for the labor market to influence people’s decisions of what they will do with their housing, but we’re getting there.”

The gain in May was the biggest since first-time buyers rushed to sign contracts before the expiration of a tax credit four years ago. Estimates in the Bloomberg survey of 37 economists ranged from a decline of 0.5 percent to an advance of 4 percent after a previously reported 0.4 percent April gain.

June Manufacturing

Another report showed manufacturing cooled in June from a month earlier. The Institute for Supply Management Inc.’s business barometer fell to 62.6 from 65.5 in May. The median forecast called for the gauge to fall to 63. Readings above 50 signal expansion.

Stocks rose after the data, with the Standard & Poor’s 500 Index advancing 0.1 percent to 1,962.86 at 10:04 a.m. in New York. The S&P Supercomposite Homebuilding Index increased 1 percent.

Purchases fell 6.9 percent from the year prior, on an unadjusted basis, after a 9.3 percent decrease in the 12 months that ended in April, the association reported.

The pending sales index was 103.9 on a seasonally-adjusted basis, the highest since September. A reading of 100 corresponds to the average level of contract activity in 2001, or “historically healthy” home-buying traffic, according to the NAR.

By Region

Pending home sales climbed in all four regions, led by an 8.8 percent gain in the Northeast. Contract signings increased 7.6 percent in West, 6.3 percent in the Midwest and 4.4 percent in the South.

Economists consider pending sales a leading indicator because they track new purchase contracts. Existing-home sales are tabulated when a contract closes, usually a month or two later.

“Solid income growth and a slight easing in underwriting standards are needed to encourage first-time buyer participation, especially as renting becomes less affordable,” NAR chief economist Lawrence Yun said as the report was released.

Home sales have been slowly emerging from a slump early this year. Purchases of new homes rose in May by the most in 22 years, increasing 18.6 percent, the biggest one-month gain since January 1992, to a 504,000 annualized pace, figures from the Commerce Department showed.

Home Prices

Gains in home prices have started to cool, which will help bring more properties within reach of those prospective buyers with access to credit.

The S&P/Case-Shiller index of property values increased 10.8 percent from April 2013, the smallest 12-month gain in more than a year, after rising 12.4 percent in March, the group reported last week.

Hovnanian Enterprises Inc., New Jersey’s largest homebuilder, is optimistic that demand will continue to rise though sales have been uneven in recent months.

BECOME A CALIFORNIA REAL ESTATE AGENT. CLICK LINK BELOW...

“While the housing market has improved dramatically overall compared to where it was a couple of years ago, the recent recovery has been a little more choppy,” Chief Executive Officer Ara Hovnanian said during an earnings conference call on June 4.

Household formation will be the primary driver of long-term housing demand, he said, and “the creation of well-paying jobs will go a long way” toward it. “Given the low levels of total U.S. housing starts, we remain convinced that we are still in the early stages of the housing industry recovery.”

Home-improvement retailers including Lowe’s Cos. also remain upbeat about the housing recovery.

“We’ve seen a bit of a downturn in housing turnover, but home prices continue to appreciate,” Chief Financial Officer Robert Hull said at a June 24 consumer conference. “As we think about the drivers of our business, both housing and income is constructive.”