Three weeks ago, Redfin published a report showing that one in four Silicon Valley home-buyers is looking to buy a home outside of Silicon Valley, up from one in seven in 2011. This digital diaspora promises to bring some of Silicon Valley’s wealth-creation to cities across the country, especially Seattle, Portland, Austin, Boston and Denver. It has already begun to increase the cost of living.

In the South Lake Union area of Seattle around Amazon, cranes fill the sky

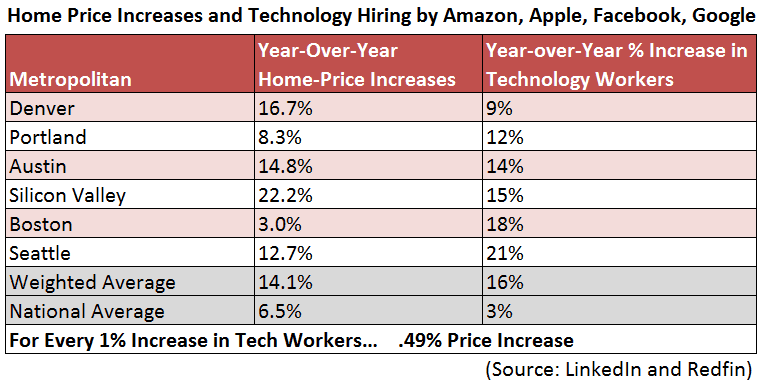

But exactly how many technology workers does it take to increase home prices in these cities? To answer that question, Redfin took the hiring of the four largest Internet-related companies — Google, Apple, Facebook and Amazon, in Silicon Valley and beyond — as a proxy for each metropolitan area’s overall growth in technology hiring. What we found is that for every 1% increase in technology workers, there’s a roughly half-percent increase in home prices above and beyond the national rate of appreciation.

When you consider that cities outside these hubs have also been hiring, with technology workers increasing nationwide by 3.4%, the home-price appreciation correlated with technology hiring is possibly higher, .63%.

In five out of six of these cities, there’s a strong correlation between above-average price appreciation and tech hiring. The only exception to the trend is Boston, which isn’t hard to understand: for decades, people have been leaving Massachusetts for warmer climes even as technology workers are coming in to key neighborhoods like Cambridge and Somerville.

Now of course, technology workers aren’t the only reason home prices are increasing faster than the national average in these cities. But if you talk to local Redfin agents in Denver, Austin, Seattle, Portland and parts of Boston, many will tell you that employees of such companies are often the ones driving bidding wars to this new, unprecedented level. And the general public has certainly come to the same conclusion.

The Cities Seeing the Fastest Technology Hiring: Seattle & Boston

When looking at growth rates in technology hiring, Seattle and Boston are growing even faster than Silicon Valley, supporting our projection that prices will increase the most in these areas. Meanwhile, the trend is more nascent in Portland and especially Denver, which has also been affected by recent local laws that give homeowners’ associations more time to sue condominium builders, drastically limiting urban new construction.

Supply and demand will only get further out of whack. According to Redfin’s Denver broker, Michelle Ackerman, Twitter has reportedly begun looking for 60,000 feet of office space to accommodate 400+ employees; Twitter currently employs about 83 in the Denver area.

Austin, the smallest of these cities, is the one least able to absorb so much change, with 708 new hires at the four Internet giants alone, out of their 4,927 total Austin employees. People who come back to Austin after two years feel as though they traveled 20 years into Austin’s future, with a new level of prosperity, but all the problems of growth seen in bigger cities, from traffic jams to higher home prices.

Seattle is Becoming a Pure Digital Technology City

What’s striking about Seattle, once known as the home of logging, airplane, retailing and life sciences industries — not to mention coffee — is that it almost has a comparable number of digital technology workers to Silicon Valley. The success of Facebook’s Seattle office has been particularly remarkable: of the 602 people profiled on LinkedIn who worked there at the end of May, more than a third, 237, had started in the last 12 months.

Which brings us to Amazon. In Seattle, nearly 1% of the entire metro area population, which stretches from Everett to Tacoma, is employed by Amazon. Amazon employs as many people in Seattle as live in the entire suburban city of Kenmore, and it adds another Kenmore every four years.

The “everything store” has become the “everyone employer,” adding 2,808 people to asatellite campus in Silicon Valley over the last 12 months. There may be another 20,000-person, 21-year-old company that could grow its staff 22% in one year, but I can’t think of one.

This analysis of course excludes the many companies besides Amazon, Apple, Facebook and Google in Silicon Valley, but it also doesn’t account for Microsoft in Seattle, which employs nearly 100,000 people, most in Redmond.

The Compounding Effect: Stock Prices

And of course there’s a compounding effect: stock prices. What’s lifting home values isn’t just the number of technology workers; it’s also their increasing wealth from stock-based pay.

Where U.S. household income grew around 1.8% in 2013, many technology workers now see a major portion of their income growing at more than 15 times that rate.

Software is Eating the World. No, Really. The Real Estate World

We always knew at a vague level that the expansion of the technology-driven economy was affecting the American city, but now we see by how much.Silicon Valley isn’t just happening in Silicon Valley anymore. And software, as Marc Andreessen likes to say, “is eating the world.” Mr. Andreessen may not have meant the literal, physical world of real estate, but now he could have.

When I bought my first house, using money earned from co-founding a software company, I couldn’t believe that such abstract work could be exchanged for something so big and tangible, hewn from forests and rocks by people sweating in the sun.

It’s a kind of prosperity that will always feel like a dream, drifting across the country like never before. The only challenge will be making it work for everyone, those in technology and all the other people who live in these cities.