A resident of the Nakagin Capsule Tower, Masato Abe, sits in his room in Tokyo on September 9, 2014. Around half of the tower's 140 capsules, designed by Japanese architect Kisho Kurokawa in 1972, are currently in use as offices, art studios and second homes. Twenty of the tiny spaces are full-time homes.

Soon enough, short of some last-minute appeal on behalf of protesters, Brill Place Tower will be shooting up from a site in Somers Town, a slightly neglected district just north of St. Pancras station in central London. The 25-story building is actually a pencil-thin pair of what dRMM, its inventive young architects, call micro-towers, built on a footprint of just 3,767 square feet. It was granted planning permission this summer, as part of a £1 billion ($1.22 billion) regeneration plan backed by Sadiq Khan, London’s populist new mayor.

Historic England, a largely government-funded heritage group, is opposed to the tower, perhaps because, like a skinny catwalk model stamping on a wedding cake, it will pierce the neoclassical skyline of white stucco terraces that encircle Regent’s Park. But whatever your architectural taste, Brill Place is very much a sign of the times. It will hold 54 of what planners call “units,” a mixture of cunningly laid out one- and two-bedroom apartments. It’s a wholly commercial development, so you can bet none of them will be cheap, although, according to dRMM, the smallest of its one-bedroom units will cover just 590 square feet. (It’s not clear if the architects include the apartment’s balcony in that calculation.) These micro-towers will hold some microhomes.

Compared with some, though, they’re palatial. In Kips Bay in Manhattan, residents paying at least $2,650 a month recently moved into New York City’s first micro-apartment building—Carmel Place, nine stories of prefabricated steel and concrete studio units, sheathed in a facade of gray bricks. Designed by nArchitects, the project is the first fruit of former Mayor Michael Bloomberg’s New Housing Marketplace Plan—a scheme launched in 2004 and intended to create 165,000 affordable homes for low- and middle-income New Yorkers. Carmel Place features 55 rental units, most of them just 260 square feet in size.

The building’s floor plans are fairly ingenious, managing to squeeze in enough room for a sofa bed, a tiny table and a narrow area of storage above the shower room and kitchen. But, like shrunken versions of the old downtown railroad apartments, they’re more corridor than home. Carmel Place does feature a gym, a shared roof terrace, a lounge and a garden, storage for bicycles and a “butler service” to replenish empty fridges. But this communal, city-center style of living is really suitable only for the young and single: Few families, however close-knit, would attempt to squeeze into such limited space.

Why Carmel Place is important has less to do with its detailed design and prefabricated factory construction than the fact that it has revolutionized planning in Manhattan: Until now, local legislation prevailed against such tiny homes. In Seattle, meanwhile, developers have been building micro-apartments as small as 199 square feet.

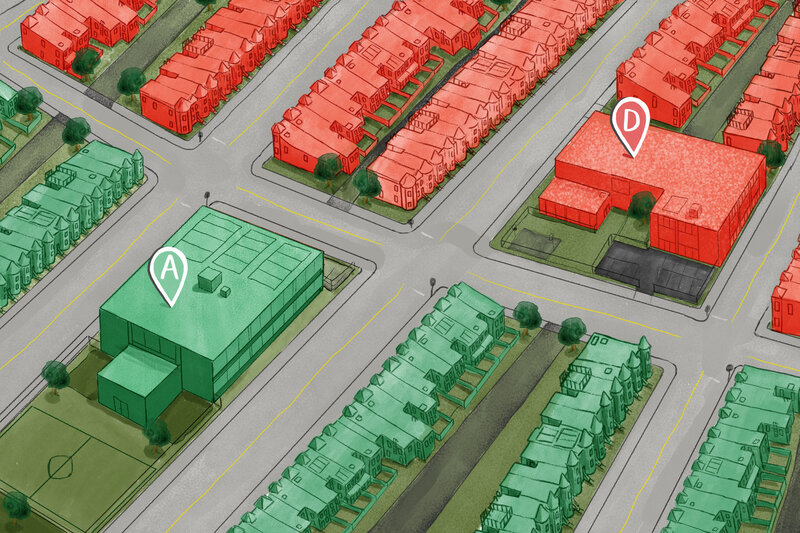

The philosophy, or sales pitch, behind this extreme degree of minimal living is that the city itself, with its bars, cafés and youthful culture, serves as all the other spaces a young person might need or want. It’s an inescapable truth that, as cities across the world grow exponentially, huge numbers of new homes are needed, for the young, for service-industry workers who otherwise would be forced to live ever farther afield, for downsizing retirees and for professionals seeking city-center pieds-à-terre. No wonder, then, that towers of micro-apartments are catching on with planners, developers, architects and the property-hungry public.

Micro-living Failures

We have been here before. Although very much back in vogue, experiments in micro-living have been made several times over the past 90 years, and the results, while fascinating, are not exactly encouraging. In the late 1960s, Tokyo boomed, and as it did, young people and modest “salary men” and their families sought affordable homes in sprawling new suburbs, commuting to the city center in the famously jam-packed Metro trains.

The late Kisho Kurokawa, then a radically minded 30-something architect, had an answer to the problem of this mass exodus of the young from Tokyo. This was his Nakagin Capsule Tower—although it was, like Brill Place, a pair of towers—completed in 1972 in the Shimbashi neighborhood. Prefabricated steel capsules, 140 of them, were bolted onto the two central concrete shafts. Each capsule provided a 94-square-foot space, into which was squeezed a bed, a kitchen surface, an aircraft-sized bathroom and the very latest in Japanese audio technology.

Nurtured in an era of minicars, miniskirts and the widespread belief that technological progress was wholly benevolent, Nakagin Capsule Tower was a much-feted, much-photographed revelation. Today, while the rest of Shimbashi is filled with expensive offices, the tower is in a sorry state. There has been no hot water here for some years. Rather than chic and futuristic micro-apartments, most of the capsules are boarded up or used for storage or as makeshift offices; a few capsules are available to rent through Airbnb. Residents wanted more space than Kurokawa could possibly offer, and although the plan had been for the capsules to be unbolted and replaced every 25 years, it failed: It was always going to be cheaper to demolish the towers and build anew, than go through all the palaver of replacing its intricate nest of high-tech capsules. This Japanese model of mass-produced city housing remains a custom-made novelty loved by architects, but shunned by the residential property market

laundry, a library, a gym and a roof terrace. This was to be a model of socialist living. Feminist living too. “Petty housework crushes, strangles and degrades,” wrote Vladimir Lenin in his essay “A Great Beginning,” saying it “chains her [the housewife of the capitalist era] to the kitchen. The real emancipation of women, real communism, will begin only where and when an all-out struggle begins…against this petty housekeeping.”

Stalin, however, put a sudden end to what he called such “Trotskyite” aberrations. Almost as soon as the first residents—some of whom installed their own tiny kitchens—moved in, the Narkomfin experiment of communal living was condemned, with rooms becoming individual, disconnected family units. Now a tarnished ragbag of empty apartments, artists’ studios and various oddball enterprises, the Narkomfin Building stands in the shadow of shiny new apartments. When, in 2004, Yuri Luzhkov, the former mayor of Moscow, opened the grotesque, 100,000-square-foot Novinsky Passage Mall, he is reputed to have said, while pointing to Ginzburg and Milinis’s yellowing masterpiece, “What a joy that in our city such wonderful new shopping centers are appearing—not such junk.”

From Junk to Trash

In spite of these failed monuments to capsule living, idealistic urban planners and architects press ahead. There's a distinct echo of the Tokyo project in a new proposal from Jeff Wilson, a former associate professor of environmental studies at Huston-Tillotson University in Austin, Texas. Wilson is perhaps best known for living for parts of 2014 and 2015 in a 33-square-foot dumpster converted into the tiniest and most unlikely home of all, but his latest project is more mobile. Called Kasita—from casita, Spanish for “little house”—it’s a proposal for prefabricated, 322-square-foot steel studios that can be slotted into a steel frame like bottles into a wine rack. The idea is that, should a resident want to move, it will be easy to lift these thoroughly equipped microapartments out from the rack and, with the help of cranes and a flatbed truck, transport them to a new location equipped with an identical steel rack.

This notion of moving home—your physical home—is certainly intriguing, although you might choose, as many American retirees have done, to invest in a motor home instead. It does highlight, however, one of the major criticisms of microliving, whether in Somers Town, Manhattan, Seattle or Texas. While tiny spaces might appeal to the young and single, what happens if a young single person meets another single young person and they produce a family?

Odds are, many will leave their micro-apartments, resulting in ever-shifting urban populations. Transience is one of the enemies of enduring communities. The more micro-apartments and towers there are, the more unsettled our city centers might become.

Will the latest wave of micro-apartments get the Luzhkov treatment and become the city slums of the future? Micro-towers may well be signs of the times, yet times change, and for most people, 260 square feet will never be quite enough.