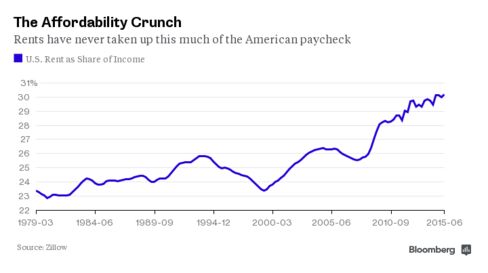

Americans living in rentals spent almost a third of their incomes on housing in the second quarter, the highest share in recent history.

Rental affordability has steadily worsened, according to a new report from Zillow, which tracked data going back to 1979. A renter making the median income in the U.S. spent 30.2 percent of her income on a median-priced apartment in the second quarter, compared with 29.5 percent a year earlier. The long-term average, from 1985 to 1999, was 24.4 percent.

|

| BECOME A CALIFORNIA REAL ESTATE AGENT...CLICK LOGO TO VIEW OUR LIVE LECTURE SCHOOL |

While mortgages remain relatively affordable, landlords have been able to increase rents because demand for apartments remains strong. The U.S. homeownership rate fell to the lowest level in almost five decades in the second quarter, as strict lending standards and tight inventories keep many families in the rental market.

Rental affordability worsened from a year earlier in 28 of the 35 largest metropolitan areas covered by Zillow. Rents were least affordable in Los Angeles, where residents devoted 49 percent of monthly income to rent. The share in San Francisco was 47 percent, 45 percent in Miami, and 41 percent in the New York metro area.

Meanwhile, historically cheap mortgage rates are keeping the cost of homeownership low. Buyers in the U.S. devoted 15 percent of their income to mortgage payments, which is less than the historical average of 21 percent. Exceptions include the Silicon Valleyarea in California, where homeowners and renters each devote 42 percent of income to housing costs.

No comments:

Post a Comment

If you have questions or a comment about this Blog or our Company please use this section. We will do our best to review and answer within 24 hours.